Hello readers know more about History of Finance, In this article, we will delve into the origins and evolution of finance, tracing its journey from ancient times to the modern era. Our expert team has meticulously researched and curated this comprehensive overview to provide our readers with valuable insights and information.

- History of Finance

- Ancient Beginnings of Finance

- Medieval and Renaissance Period

- Industrial Revolution and the Birth of Modern Finance.

- 20th Century and the Age of Technology

- Modern Finance and Globalization

- Current Trends and Future Outlook

- The Barter System and the Development of Currency

- The Creation of Banks and the Industrial Revolution

- Establishment of Stock Exchanges and the Growth of Global Financial Markets

- Advent of Computers and the Internet

- Conclusion

History of Finance

Finance, as we know it today, plays a pivotal role in the global economy. However, its roots can be traced back to ancient civilizations where rudimentary forms of financial systems existed. Over time, finance has evolved in response to societal, economic, and technological changes, shaping the world of commerce and investment as we know it. In this article, we will take a closer look at the fascinating journey of finance through History of Finance.

Ancient Beginnings of Finance

The history of finance dates back to ancient times, where rudimentary financial practices were prevalent. In Mesopotamia, one of the earliest known civilizations, records from around 2000 BCE reveal the use of clay tablets as a medium of exchange, serving as an early form of currency. This was a significant development in the evolution of finance, as it marked the shift from barter to a more sophisticated system of trade.

With the rise of empires, such as the Roman Empire, in the classical era, financial practices became more structured. The concept of banking emerged, with temples serving as repositories for wealth and providing loans to traders and merchants. Moreover, the use of bills of exchange, a precursor to modern-day checks, facilitated long-distance trade and commerce.

Medieval and Renaissance Period

During the medieval period, the evolution of finance continued to gather pace. In Europe, the growth of trade and commerce led to the establishment of merchant guilds, which acted as intermediaries in commercial transactions and provided credit to their members. The emergence of double-entry bookkeeping in the late medieval period, pioneered by Italian mathematician Luca Pacioli, brought about a revolutionary change in financial record-keeping and laid the foundation for modern accounting practices.

The Renaissance period witnessed further advancements in finance, with the establishment of the world’s first public bank, Bank of Stockholm, in 1668. This marked a crucial milestone in the evolution of banking, as it laid the groundwork for the development of modern central banks.

Industrial Revolution and the Birth of Modern Finance.

The Industrial Revolution in the 18th century transformed the economic landscape and had a profound impact on the evolution of finance. The growth of industries and the expansion of global trade led to the emergence of joint-stock companies, which allowed for the pooling of capital and the issuance of shares to investors. This marked the birth of modern finance, as it introduced concepts such as equity ownership and dividend payments.

The 19th century witnessed further financial innovations, including the establishment of stock exchanges, such as the New York Stock Exchange (NYSE), and the development of the telegraph, which revolutionized communication and enabled faster transmission of financial information. These developments facilitated the growth of financial markets and paved the way for the rise of investment banking and the development of modern financial instruments, such as bonds and derivatives.

20th Century and the Age of Technology

The 20th century brought unprecedented changes to the world of finance, with advancements in technology playing a pivotal role. The advent of computers and the internet revolutionized the way financial transactions were conducted, leading to the automation of processes and the growth of online banking and electronic trading.

One of the significant milestones in the 20th century was the establishment of the Bretton Woods system in 1944, which aimed to create stability in the global financial system after World War II. This system pegged currencies to the US dollar and laid the foundation for international financial institutions such as the International Monetary Fund (IMF) and the World Bank.

With the rapid growth of information technology, financial markets became more accessible, efficient, and interconnected. The development of electronic trading platforms and the rise of high-frequency trading transformed the landscape of financial markets, making them more complex and competitive.

Modern Finance and Globalization

In recent decades, finance has become increasingly globalized, with the integration of financial markets across countries and regions. The liberalization of financial markets, along with advancements in telecommunications and transportation, has facilitated the flow of capital, goods, and services across borders, leading to the rise of multinational corporations and the globalization of finance.

The evolution of financial instruments and products has also been instrumental in shaping modern finance. The development of securitization, which involves pooling and repackaging of financial assets into tradable securities, has led to the creation of complex financial products such as mortgage-backed securities and collateralized debt obligations.

Moreover, the expansion of derivatives markets, including futures and options, has provided investors with new avenues for risk management and speculation. These financial innovations have contributed to the growth and diversification of financial markets, but have also posed challenges in terms of risk management and regulatory oversight.

Current Trends and Future Outlook

The landscape of finance continues to evolve rapidly, with emerging technologies, regulatory changes, and changing consumer preferences shaping the industry’s future. In recent years, there has been a growing focus on sustainability and responsible investing, with the integration of environmental, social, and governance (ESG) factors into investment decisions. This trend is expected to gain further momentum, with investors increasingly seeking to align their investments with their values and long-term sustainability goals.

Another significant trend is the rise of fintech, which refers to the application of technology to financial services. Fintech has disrupted traditional financial models, with the development of digital payment systems, online lending platforms, and robo-advisors, among others. These innovations have made financial services more accessible, efficient, and user-friendly, but have also raised concerns around data privacy, cybersecurity, and regulatory compliance.

Looking ahead, the future of finance is likely to be shaped by technological advancements, changing customer expectations, and evolving regulatory frameworks. The adoption of blockchain technology, for instance, has the potential to revolutionize financial transactions, with its decentralized and transparent nature offering new opportunities for efficiency and security.

Furthermore, regulatory reforms aimed at enhancing transparency, reducing systemic risks, and promoting financial stability are expected to continue shaping the financial landscape. The increased focus on sustainable finance and responsible investing is also expected to gain traction, as stakeholders demand more accountability and transparency in financial decision-making.

The Barter System and the Development of Currency

The history of finance can be traced back to the earliest form of exchange known as the barter system, where goods and services were exchanged directly without the need for a common medium of exchange. However, this system had its limitations, such as the lack of a standard measure of value and the difficulties in finding parties with complementary needs.

To overcome these limitations, the development of currency emerged as a significant milestone in the history of finance. Currency, in the form of coins or paper money, served as a medium of exchange that facilitated trade and commerce. The use of currency provided a standardized measure of value, making transactions more efficient and convenient. History of Finance

The Creation of Banks and the Industrial Revolution

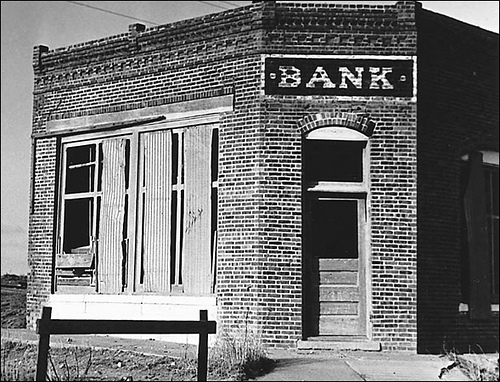

The establishment of banks marked another pivotal moment in the history of finance. Banks provided a safe place for individuals and businesses to deposit their money and access credit, enabling them to invest, save, and borrow. The creation of banks facilitated the flow of capital, promoted economic growth, and laid the foundation for modern banking systems.

The Industrial Revolution in the 18th and 19th centuries brought about significant changes in the world of finance. The mechanization of production and the expansion of trade and commerce led to increased demand for capital, and banks played a crucial role in providing financing for industrial enterprises. The development of joint-stock companies and the issuance of shares also facilitated investment and ownership in companies, laying the groundwork for modern corporate finance.

Establishment of Stock Exchanges and the Growth of Global Financial Markets

The establishment of stock exchanges in the 17th and 18th centuries marked a significant milestone in the history of finance. Stock exchanges provided a regulated platform for buying and selling shares of publicly traded companies, facilitating investment and capital formation. The emergence of stock exchanges paved the way for the growth of global financial markets, enabling investors to trade securities across borders and facilitating capital flows.

Over time, financial markets became more complex and sophisticated, with the introduction of new financial instruments such as bonds, commodities, and derivatives. The development of capital markets and the expansion of financial products and services provided new avenues for investment, risk management, and speculation. This led to the growth of global financial centers, such as Wall Street in the United States, the City of London in the United Kingdom, and Tokyo in Japan, which became hubs of international finance.

Advent of Computers and the Internet

The advent of computers and the internet in the 20th century brought about a revolution in the world of finance. The use of computers and electronic communication networks (ECNs) transformed the way financial transactions were conducted, leading to the automation of processes and the growth of online banking and electronic trading. History of Finance

Computer algorithms and mathematical models enabled the development of sophisticated trading strategies, such as high-frequency trading, which involves the use of powerful computers to execute large volumes of trades in milliseconds. The rise of electronic trading platforms provided investors with greater access to global financial markets, making trading more efficient, transparent, and accessible.

Conclusion

We have been learned in this article about the History of Finance, how dose it started in the history. Hope you enjoyed it …

Visit for More articles : Infoclubz

Install TurboTax @ Official Site :