ATM Investments has emerged as an intriguing option for individuals seeking to diversify their investment portfolios while generating a steady stream of passive income. As technological advancements continue to reshape the financial landscape, the potential for lucrative returns through ATM investments has garnered significant attention.

In this article, we will explore the various aspects of ATM investments, including their benefits, associated risks, factors to consider, and steps to start investing. So, let’s delve into the world of ATM investments and discover the key insights that can pave the way for your financial success.

- Introduction : ATM Business

- Types of ATM Machine Investments

- Benefits of ATM Investments / atm return on investment

- The Unusual and Shocking Benefits of ATM Investing

- How much money can you make owning an atm machine :

- Risks Associated with ATM Investments : atm ownership

- Why is owning an ATM a good investment?

- Factors to Consider Before Investing in ATMs

- How can I invest in an ATM ? : Steps to Start Investing in ATMs

- Best Practices for ATM Investment Success

- Case Studies: Successful ATM Investments

- Conclusion

- FAQs

Introduction : ATM Business

Definition of ATM machine Investments

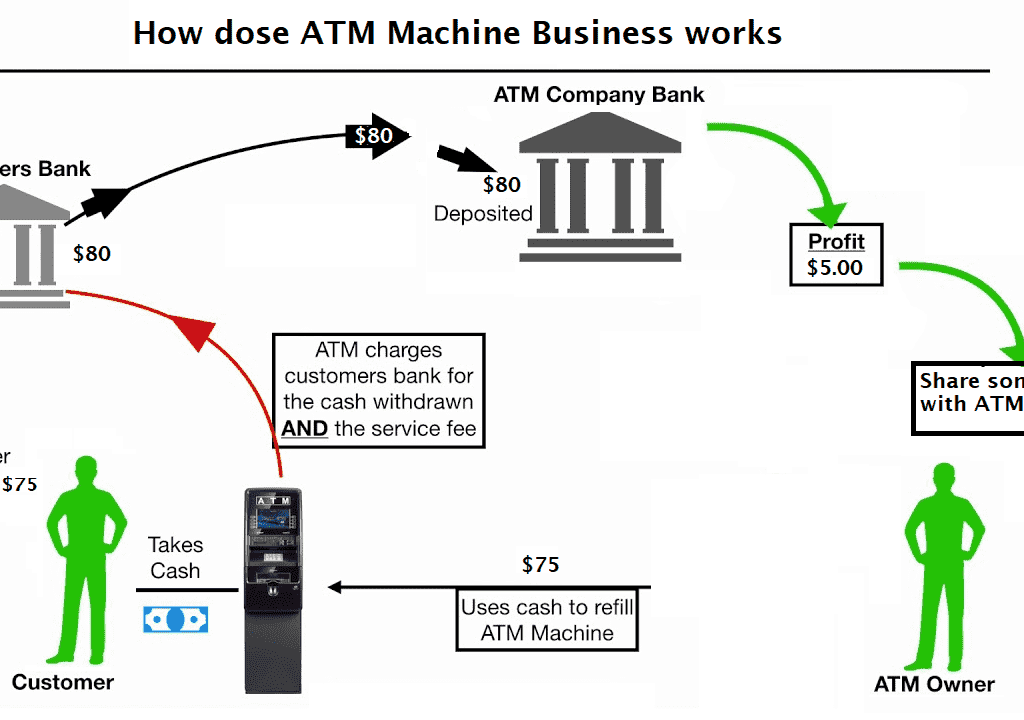

ATM investments refer to the process of acquiring and owning Automated Teller Machines with the objective of generating a return on investment (ROI) through transaction fees and surcharges imposed on ATM users. As financial institutions and businesses worldwide rely on ATMs to provide convenient cash withdrawal and other banking services, investing in this sector presents an opportunity to participate in a growing market.

Importance of ATM Investments in the Financial Market

ATMs play a crucial role in providing individuals with access to cash and banking services at their convenience. The widespread usage of ATMs highlights their significance in the financial market. By understanding the dynamics of ATM investments, investors can tap into this market and potentially benefit from its profitability.

Types of ATM Machine Investments

types of ATM investments are as follow as :

Traditional ATM Investments

Traditional ATM investments involve acquiring and deploying ATMs in locations such as shopping malls, convenience stores, and high-traffic areas. These ATMs are connected to banking networks, enabling customers to withdraw cash, check their account balances, and perform other basic transactions.

Bitcoin ATMs and Cryptocurrency Investments

With the rise of cryptocurrencies, Bitcoin ATMs have gained popularity as an alternative investment option. Bitcoin ATMs allow users to buy or sell cryptocurrencies using cash or debit/credit cards. Investing in Bitcoin ATMs offers exposure to the growing demand for digital assets and provides a gateway for individuals to enter the world of cryptocurrencies.

Benefits of ATM Investments / atm return on investment

The Unusual and Shocking Benefits of ATM Investing

Passive Income Generation

One of the primary advantages of ATM investments is the potential to generate passive income. As ATM users withdraw cash and pay transaction fees, investors can earn a percentage of these fees, which contributes to a consistent revenue stream without active involvement.

Diversification of Investment Portfolio

ATM investments provide an opportunity to diversify investment portfolios beyond traditional asset classes. By adding ATMs to their portfolios, investors can reduce their reliance on stocks, bonds, or real estate, thereby spreading their risk across different types of investments.

Potential for High Returns

ATM investments have the potential to yield attractive returns. While the exact returns depend on factors such as location, foot traffic, and transaction volume, a well-placed and properly managed ATM can deliver significant profits over time.

Convenience and Accessibility

Investing in ATMs offers the advantage of convenience and accessibility. Unlike other investments that may require active management or complex processes, ATMs operate autonomously, providing financial services 24/7 to users. This convenience factor translates into higher usage and, consequently, increased potential for returns.

How much money can you make owning an atm machine :

The amount of money you can make owning an ATM machine depends on various factors, including the location of the ATM, transaction volume, fees charged, and operating costs. While it is challenging to provide an exact figure, let’s explore the potential income streams from owning an ATM:

- Transaction Fees: One of the primary sources of revenue for ATM owners is the transaction fees charged to ATM users. The fee amount is typically set by the owner and can vary depending on the location and market rates. Transaction fees typically range from a few dollars to a percentage of the withdrawal amount. The more transactions your ATM processes, the higher your potential income from fees.

- Surcharge Revenue: When an ATM user withdraws cash from an ATM not affiliated with their bank, they are often subject to a surcharge fee. As an ATM owner, you earn this surcharge fee, which is typically higher than the interchange fee paid to the ATM user’s bank. The surcharge revenue can significantly contribute to your overall income.

- Additional Services: Some ATMs offer additional services like balance inquiries, account transfers, or prepaid card loading. These services can generate additional income through transaction fees. Offering such services can attract more users and increase the revenue potential of your ATM.

- Location and Foot Traffic: The success of an ATM investment greatly depends on its location and the amount of foot traffic it receives. ATMs placed in high-traffic areas with limited access to banking services have the potential to attract a large number of users, leading to higher transaction volumes and increased income.

- Operating Costs: It’s important to consider the operating costs associated with owning an ATM. These costs may include equipment maintenance, cash replenishment fees, communication and network fees, insurance, licensing, and any necessary repairs. Deducting these expenses from your revenue will provide a more accurate estimate of your net income.

While specific earnings can vary, successful ATM owners often aim for a return on investment (ROI) ranging from 10% to 25% annually. However, it’s essential to note that individual results may differ based on factors such as location, market conditions, and operational efficiency.

To determine the potential income from owning an ATM, conduct thorough market research, estimate transaction volumes based on foot traffic, and factor in the prevailing transaction fees and operating costs. Consulting with ATM service providers, financial advisors, or other ATM owners can also provide valuable insights into income projections and profitability.

Risks Associated with ATM Investments : atm ownership

Market Volatility and Regulatory Risks

As with any investment, ATM investments come with their share of risks. Market volatility can impact the usage and profitability of ATMs, especially during economic downturns. Additionally, regulatory changes and compliance requirements imposed by financial authorities can affect the operations and revenue streams of ATM investments.

Maintenance and Operational Costs

Owning and operating ATMs entail maintenance and operational costs. Regular maintenance, cash replenishment, software updates, and transaction processing fees can impact the profitability of ATM investments. It is crucial for investors to consider these costs when assessing the overall viability of their investment.

Security Concerns and Fraud Risks

ATMs are susceptible to security breaches and fraudulent activities. Skimming, card trapping, and other forms of ATM-related fraud can result in financial losses. Implementing robust security measures, such as surveillance systems, encryption technology, and fraud prevention protocols, is essential to mitigate these risks.

Why is owning an ATM a good investment?

Owning an ATM can be a compelling investment for several reasons. Let’s explore why it is considered a good investment opportunity:

- Passive Income

- Steady Cash Flow

- Recession-Resistant

- Low Maintenance Costs

- Diversification of Income

- Potential for High Returns

- Long-Term Investment

- Flexibility and Scalability

However, it’s important to note that successful ATM ownership requires careful research, planning, and ongoing management. Factors such as location selection, operational efficiency, and adherence to legal and regulatory requirements are critical to maximizing the return on your investment. Consulting with industry professionals and conducting thorough market analysis can significantly enhance the success of your ATM investment.

Factors to Consider Before Investing in ATMs

Location and Target Market Analysis

Choosing the right location for an ATM is crucial for its success. Conducting a thorough analysis of foot traffic, demographics, nearby businesses, and competition can help determine the optimal placement for maximum usage and profitability. Identifying the target market and tailoring the services to their needs further enhances the investment’s potential.

Financial Projections and ROI Calculation

Before investing in ATMs, it is essential to evaluate the financial viability of the venture. Conducting financial projections, calculating the return on investment (ROI), and assessing the payback period can provide insights into the profitability and long-term sustainability of the investment.

Provider Reputation and Support

Selecting a reputable ATM provider is crucial for a successful investment. Consider factors such as the provider’s track record, customer support services, and available maintenance and repair options. A reliable provider can offer guidance, technical assistance, and ongoing support, ensuring the smooth operation of the ATM investment.

Legal and Compliance Considerations

Complying with legal and regulatory requirements is essential in the ATM industry. Familiarize yourself with local laws, licensing obligations, and compliance standards to ensure that your investment operates within the legal framework. Partnering with legal advisors and industry experts can help navigate the complex landscape of regulatory compliance.

How can I invest in an ATM ? : Steps to Start Investing in ATMs

Research and Education

Begin by conducting extensive research and educating yourself about the ATM industry. Understand the market trends, industry dynamics, and best practices for successful ATM investments. Engage with industry forums, attend conferences, and seek insights from experienced investors to gain a comprehensive understanding of the field.

Funding Options and Capital Requirements

Evaluate your funding options and determine the capital required to acquire and operate an ATM. Funding sources may include personal savings, loans, partnerships, or crowdfunding platforms. Consider the initial investment costs, ongoing operational expenses, and contingency funds to ensure the financial viability of the investment.

Equipment Selection and Procurement

Selecting the right ATM equipment is crucial for the investment’s success. Consider factors such as brand reputation, features, reliability, security enhancements, and compatibility with banking networks. Collaborate with reputable ATM manufacturers or distributors to acquire the necessary equipment for your investment.

Installation and Setup Process

After acquiring the ATM, follow the installation and setup process diligently. Engage professionals or enlist the support of the ATM provider to ensure a smooth and secure installation. Test the equipment thoroughly, establish network connectivity, and configure the necessary settings to ensure seamless operations.

Best Practices for ATM Investment Success

Regular Monitoring and Maintenance

To maximize the profitability of ATM investments, regular monitoring and maintenance are essential. Monitor transaction volumes, cash levels, and equipment performance to identify and address any issues promptly. Implement preventive maintenance schedules and establish relationships with reliable service providers to minimize downtime and optimize revenue generation.

Cash Management Strategies

Efficient cash management is vital for ATM investments. Analyze transaction patterns, monitor cash flow, and optimize cash replenishment cycles to ensure sufficient funds are available to meet user demand while minimizing idle cash. Implementing robust cash management practices reduces the risk of cash shortages and increases the return on investment.

Marketing and Promotion Techniques

Promoting your ATM investment is crucial to attract users and drive transaction volumes. Employ marketing and promotional techniques such as signage, social media campaigns, and partnerships with local businesses to increase awareness and foot traffic. Highlight the convenience, accessibility, and additional services your ATM offers to entice potential users.

Keeping Up with Technological Advancements

The ATM industry is constantly evolving with technological advancements. Stay informed about the latest trends, security enhancements, and software updates to ensure your ATM investment remains competitive and meets the evolving needs of users. Embrace innovations such as contactless payments, biometric authentication, and value-added services to enhance user experience and maximize returns.

Case Studies: Successful ATM Investments

Real-Life Examples of Profitable ATM Investments

Examining real-life examples of successful ATM investments can provide valuable insights and inspiration. Case studies showcasing the profitability, challenges faced, and strategies employed by experienced investors can help guide

Example 1: John’s Corner Store ATM

John, a small business owner, decided to invest in an ATM for his convenience store located in a bustling neighborhood. Through careful market analysis, John identified a high foot traffic area with limited access to banking services. After installing an ATM in his store, John experienced a significant increase in customer traffic, leading to a boost in sales. The ATM generated a steady stream of transaction fees, resulting in a substantial return on investment within a short period.

Example 2: CryptoATM Ventures

CryptoATM Ventures, a company specializing in cryptocurrency investments, recognized the growing demand for Bitcoin ATMs. They strategically placed Bitcoin ATMs in popular tourist destinations, where visitors sought convenient options for buying and selling cryptocurrencies. By leveraging the increasing interest in digital assets, CryptoATM Ventures experienced rapid growth in transaction volumes and generated substantial profits from transaction fees. Their success demonstrates the potential of innovative ATM investments beyond traditional banking services.

Conclusion

Investing in ATMs offers a unique opportunity to diversify investment portfolios, generate passive income, and tap into the growing demand for convenient financial services. However, it is essential to consider the associated risks, conduct thorough research, and make informed decisions. By analyzing factors such as location, financial projections, provider reputation, and compliance considerations, investors can increase their chances of success. Implementing best practices, such as regular monitoring, efficient cash management, effective marketing, and embracing technological advancements, can further optimize the profitability of ATM investments.

In conclusion, ATM investments present a promising avenue for individuals seeking financial stability and passive income. By carefully navigating the landscape of ATM investments, investors can unlock the potential for substantial returns while providing valuable services to customers in need of convenient cash access and digital asset transactions.

FAQs

Are ATM investments suitable for beginners?

ATM investments require thorough research, understanding of the industry, and careful decision-making. While beginners can enter the field with proper education and guidance, it is advisable to consult with experienced investors or seek professional advice before venturing into ATM investments.

How can I mitigate security risks associated with ATMs?

Mitigating security risks involves implementing robust security measures such as surveillance systems, encryption technology, regular software updates, and fraud prevention protocols. Collaborating with experienced ATM providers and staying updated on the latest security advancements can enhance the security of your ATM investment.

Can I invest in ATMs remotely?

Yes, investing in ATMs remotely is possible. Some ATM providers offer remote management services, allowing investors to monitor and manage their ATMs from a centralized platform. Remote access enables investors to track transaction volumes, cash levels, and perform software updates without being physically present at the ATM location.

What are the tax implications of ATM investments?

The tax implications of ATM investments can vary based on jurisdiction and local tax regulations. It is advisable to consult with tax professionals or accountants experienced in investment taxation to understand the specific tax obligations and benefits associated with ATM investments in your region.

1 Comment

Pingback: How to Get Money out of a Trust Fund ? : in 5 steps - Info Clubz