Personal Budget.. Are you tired of constantly living paycheck to paycheck and wondering where all your money goes? Creating a Personal Budget can help you take control of your finances and achieve your financial goals. In this article, we will walk you through the six simple steps to creating a budget that works for you. lets learn to Create a Personal Budget with “infoClubz“.

At Info-Clubz, we believe that creating and sticking to a budget is essential to achieving financial success. Whether you are looking to pay off debt, save for a major purchase, or simply want to have a better understanding of your financial situation, a budget can help you get there. In this guide, we’ll walk you through the steps to create a budget that works for you.

We understand that making a budget can be daunting, especially if you’re not sure where to start. That’s why we’re here to help. In this article, we will guide you through the process of creating a budget that works for you and your lifestyle.

- Why Creating a Personal Budget Guide is Essential

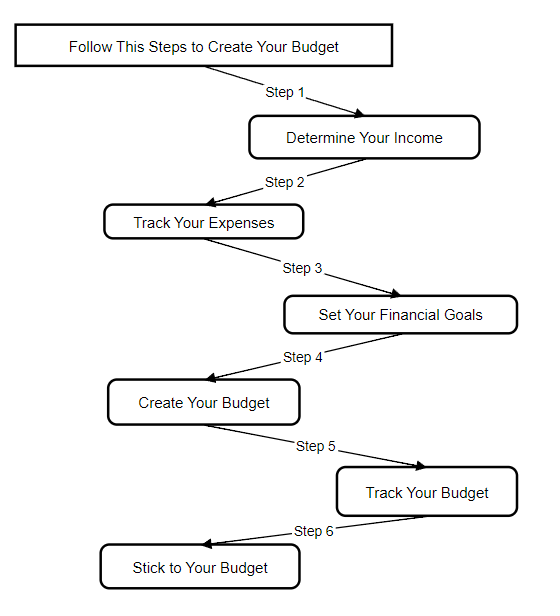

- Step 1: Determine Your Current Financial Situation

- Step 2: Track Your Expenses

- Step 3: Set Your Financial Goals

- Step 4: Create Your Personal Budget

- Step 5: Track Your Personal Budget

- Step 6: Stick to Your Personal Budget

- Step 7: Review and Adjust Your Personal Budget

- FAQ's

Why Creating a Personal Budget Guide is Essential

Creating a budget guide is essential for anyone who wants to manage their finances effectively. A budget is a plan that outlines your income and expenses, and it helps you to prioritize your spending and make informed decisions about your money. By creating a budget guide, you’ll be able to:

- Track your Income: Will help you to track your income.

- Track your spending: By creating a budget guide, you’ll be able to keep track of your expenses and see where your money is going, Identify areas where you are overspending.

- Save money: By setting financial goals and sticking to a budget, you’ll be able to save money and reach your financial goals faster, Save money for emergencies and long-term goals.

- Avoid debt: By keeping track of your expenses and living within your means, you’ll be able to avoid getting into debt.

Step 1: Determine Your Current Financial Situation

This includes your regular salary or wages, any additional income from side jobs or freelance work, and any government benefits you may receive. Make a list of all your sources of income and add them up to get your total monthly income.

Next, make a list of all of your income sources, including your salary, bonuses, and any other sources of income. Then, make a list of all of your monthly expenses, including your rent or mortgage payment, utilities, groceries, transportation, and any other expenses.

Finally, make a list of all of your debts, including credit card balances, loans, and any other outstanding balances. Also, make a list of your savings, including any retirement accounts, emergency funds, or other savings accounts.

Before you can create a budget, you need to know how much money you have coming in each month. This includes your regular salary or wages, any additional income from side jobs or freelance work, and any government benefits you may receive. Make a list of all your sources of income and add them up to get your total monthly income.

Step 2: Track Your Expenses

To create an effective budget, you need to know where your money is going each month. Track your expenses for a month by writing down every purchase you make, including bills, groceries, and discretionary spending. At the end of the month, categorize your expenses and add them up to get your total monthly expenses.

List Your Expenses

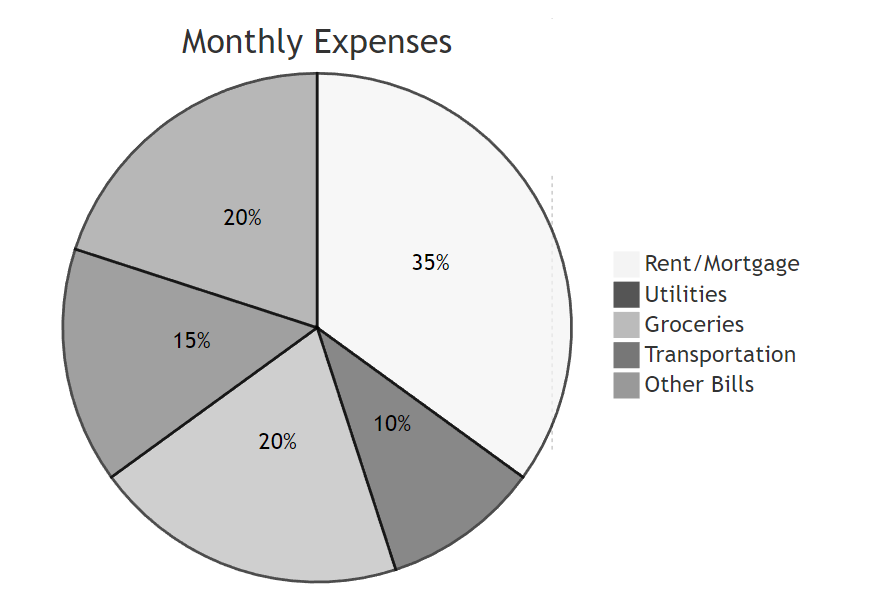

Next, make a list of all your monthly expenses. This should include everything from rent/mortgage payments to utility bills, groceries, transportation costs, and any other regular expenses. It’s also important to include any irregular expenses, such as car repairs, medical bills, and other unexpected costs that may come up.

Categorize Your Expenses

Once you have a list of all your expenses, it’s time to categorize them. This will help you identify areas where you may be overspending and where you can cut back. Common categories include housing, transportation, food, entertainment, and debt payments.

Step 3: Set Your Financial Goals

Before you start creating your Personal Budget, you need to identify your financial goals. This could include paying off debt, saving for a down payment on a house, or building an emergency fund. Once you have identified your goals, you can allocate your money accordingly in your budget.

Once you have a clear understanding of your current financial situation, you can start to set financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound. For example, if you want to pay off your credit card debt, your goal might be to pay off $5,000 in credit card debt within the next year.

Other common financial goals might include saving for a down payment on a house, saving for retirement, or building an emergency fund.

Step 4: Create Your Personal Budget

Now that you have a clear understanding of your current financial situation and your financial goals, you can start to create a Personal Budget.

As you have all the necessary information, it’s time to create your Personal Budget. Start by subtracting your total monthly expenses from your total monthly income. This will give you your disposable income. Allocate your disposable income to your financial goals and other discretionary spending categories, such as entertainment or dining out.

Your Personal Budget should be based on your income, expenses, and financial goals.

Start by listing all of your income sources at the top of the page. Then, list all of your expenses below your income. Be sure to categorize your expenses, such as housing, transportation, food, entertainment, and so on. Finally, subtract your total expenses from your total income to see if you have a surplus or a deficit.

If you have a surplus, consider putting that money towards your financial goals. If you have a deficit, look for ways to reduce your expenses or increase your income.

Step 5: Track Your Personal Budget

Once you have created a Personal Budget, it’s important to track your spending to make sure you are staying within your budget. You can use a spreadsheet or a budgeting app to track your spending.

Be sure to review your budget regularly and make adjustments as necessary. If you find that you are consistently overspending in a certain category, consider reducing your budget in that category.

Step 6: Stick to Your Personal Budget

Creating a budget is only the first step. The key to success is sticking to it. Monitor your spending throughout the month to ensure that you are staying on track. If you find yourself overspending in a certain category, adjust your Personal Budget accordingly.

Finally, it’s important to stick to your budget. This means avoiding unnecessary purchases and staying within your budgeted amounts for each category. It’s okay to make adjustments to your budget as needed, but try to avoid making major changes that will throw off your financial goals.

In conclusion, creating a Personal Budget is a critical step towards achieving your financial goals. By assessing your current financial situation, setting financial goals, creating a budget, tracking your spending, and sticking to your budget, you can take control of your finances and achieve financial success.

Tips for Sticking to Your Personal Budget

Creating a Personal Budget guide is only half the battle. The other half is sticking to it. Here are some tips to help you stay on track:

- Use budgeting apps: There are many budgeting apps available that can help you keep track of your expenses and stay on budget.

- Make it a habit: Make budgeting a habit by doing it regularly, such as every week or every month.

- Be realistic: Be realistic when setting financial goals and budgeting for expenses. Don’t set yourself up for failure by being too ambitious.

- Be flexible: Be flexible with your budget and adjust it as needed. Life happens, and unexpected expenses can arise.

Step 7: Review and Adjust Your Personal Budget

Your Personal Budget should be a living document that you review and adjust regularly. Revisit your budget every few months to ensure that it is still working for you. If your income or expenses change, adjust your budget accordingly. It’s also important to celebrate your successes and make adjustments as needed to stay motivated and on track.

In conclusion, creating a Personal Budget may seem overwhelming at first, but it is an essential step towards achieving your financial goals. By following these six simple steps, you can take control of your finances and start making progress towards the life you want.

FAQ’s

Can I still have fun while budgeting?

Yes! Budgeting doesn’t mean you have to give up all your discretionary spending. Just be mindful of how much you’re spending and make sure it aligns with your financial goals.

What if my income varies each month?

If your income varies each month, use an average of your last few months’ income as your starting point for budgeting.

How do I deal with unexpected expenses?

Build an emergency fund into your budget to cover unexpected expenses, such as car repairs or medical bills.

What if I don’t have enough disposable income to meet my financial goals?

If you don’t have enough disposable income to meet your financial goals, look for ways to increase your income or reduce your expenses. You may also need to adjust your goals to be more realistic.

By following these steps, you can create a budget that works for you and your lifestyle. Remember, a budget is a living document, and it may need to be adjusted over time as your income and expenses change. But with a little bit of effort and dedication, you can take control of your finances and achieve your financial goals.

5 Comments

Pingback: FORMULATEXT Function Excel : "Formulate Your Excel Spreadsheets with 10 Powerful Benefits " - Info Club

Pingback: What Companies are in the public utilities field : Top 10 Companies in the Public Utilities Field Empowering Your Portfolio - Info Club

Pingback: Download & Install TurboTax @ Official Site in 5 Steps: Your Ultimate Guide to Effortless Tax Filing. -

Pingback: How to Effectively Hide a Bank Account with 7 Steps : A Comprehensive Guide - Info Clubz

Pingback: Budgeting and Forecasting: Budget for the ultimate growth. - Info Clubz