- Understanding Behavioral Finance : Concepts, Examples & Importance.

- Financial Behavior in the Stock Market.

- Why we make bad financial choices-- even when we know better | Your Money and Your Mind

- What Can We Learn From Behavioral Finance?

- What Distinctions Can Be Made Between Behavioral Finance And Traditional Financial Theory?

- How Is It Helpful to Understand Behavioral Finance?

- What's an illustration of a behavioral finance finding?

- Decision-Making Errors and Biases

- Understanding Investor Behavior

- Trading Psychology

- Market Psychology

- The Field of Behavioral Finance is Expanding

- Behavioral interview questions with answers

- FAQs :

Understanding Behavioral Finance : Concepts, Examples & Importance.

What is Behavioral Finance ? : Concepts of Behavioral Finance.

What is Behavioral Finance ? Lets see the definition of Behavioral Finance:

The study of psychological biases and emotions as they relate to financial decision-making is known as behavioral finance. An interdisciplinary field called behavioral finance brings together ideas from the financial, economic, and psychological sciences to better understand how psychological aspects affect financial decision-making. It aims to shed light on the reasons for occasionally irrational investment choices and how these choices can result in market inefficiencies and oddities.

Behavioural finance acknowledges that investors are human and are prone to biases, emotions, and other psychological elements that might affect their decision-making, in contrast to classic financial theory, which presumes that investors are always rational and behave in their own best interests.

Behavioral finance aims to provide a more thorough understanding of financial markets and to develop strategies for enhancing investment outcomes by researching the cognitive and emotional processes that influence financial decision-making. It has real-world uses in fields including investment management, budgeting, and public policy.

The following are some key concepts of behavioral finance:

- Loss aversion

- Confirmation bias

- Herding Behavior

- Anchoring bias

- Overconfidence

- Mental accounting

Individuals can make better financial decisions and avoid typical biases that might have a detrimental impact on their financial outcomes by understanding these and other behavioral finance concepts.

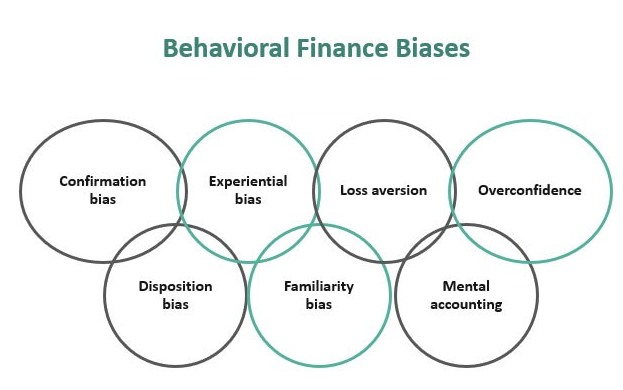

What Are Some Examples of Behavioral Finance Biases?

There are a number of biases that can influence financial decision-making, according to behavioral finance. Some of the most typical biases are listed below:

- Confirmation bias : This happens when individuals dismiss information that conflicts with their pre-existing ideas in favour of information that supports their beliefs. It can result in a resistance to alter course when fresh evidence indicates that it could be required in the context of investment.

- Loss aversion : When people experience the agony of losing money more keenly than the joy of earning the same amount, this bias takes place. It may result in cautious investing choices and premature sale of profitable investments.

- Anchoring bias : This happens when people base their decisions too much on the initial piece of information they learn. It might result in a reluctance to change investment choices, even when fresh data suggests that doing so might be necessary.

- Overconfidence : When it comes to making financial judgements, people tend to overestimate their skills and expertise, which leads to this bias. It can result in dangerous investing choices and an exaggerated belief in one’s capacity to foresee market trends.

- Herding behavior : This happens when people imitate their peers’ behaviour and make comparable financial judgements. It might result in crashes and unreasonable investment bubbles.

- Mental accounting : Even though they are all a part of the same portfolio, this happens when separate money pools are treated differently. It could cause people to make erroneous investing choices based on fabricated mental obstacles.

People can choose more wisely and steer clear of frequent mistakes by being aware of these biases and how they may affect financial decision-making.

Recognising the biases in behavioral finance

As behavioural finance is predicated on the notion that people may make poor decisions as a result of psychological biases and emotional reactions, understanding biases is crucial.

Understanding typical cognitive and emotional biases, such as overconfidence, loss aversion, and herding behaviour, is one approach to spot biases. These biases can have a number of effects on decision-making, such as making people take on too much risk or miss out on opportunities.

Finding patterns in one’s own or other people’s behaviour is another method for spotting biases. For instance, behavioral biases may be at work if someone repeatedly makes impulsive financial decisions or goes with the flow rather than doing their own study.

Last but not least, identifying biases can involve searching out various viewpoints and ideas in order to mitigate the impacts of confirmation bias and other potential prejudices.

In general, becoming aware of biases is a critical first step to understanding behavioral finance and improving financial decision-making. People can take steps to overcome these biases and make better financial decisions by being aware of them and how they might affect them.

Why is Behavioral Finance Important ?

Because it offers a more thorough understanding of financial markets and investment decision-making, behavioral finance is significant. Investors are thought to be logical, impartial, and always act in their own best interests, according to traditional financial theory. However, behavioral finance acknowledges that since investors are also people, they are susceptible to prejudices, emotions, and other psychological factors that may influence their choice of investments.

Investors can make more educated and successful investing selections by knowing these psychological aspects and how they may affect their decision-making process. Investors’ chances of attaining their long-term financial goals can be increased by learning to recognise and manage their own biases with the aid of behavioral finance.

Overall, behavioral finance provides a more nuanced and realistic understanding of financial markets and investment decision-making, which can improve outcomes for investors and promote a more stable and efficient financial system.

Financial Behavior in the Stock Market.

The actions and choices made by investors when buying and selling stocks are referred to as financial behaviour in the stock market. According to behavioral finance, investors are not always unbiased and are subject to psychological biases and emotions, which can result in less than ideal investing decisions.

For instance, investors may exhibit herding behaviour, which involves copying what their peers do and making similar financial judgements. This could result in illogical bubbles and crashes in the stock market.

Overconfident investors may also experience these problems, thinking they are more knowledgeable or skilled than they actually are. This may cause them to overestimate their abilities to forecast market trends and make unsafe investment decisions.

Another typical behaviour in the stock market is loss aversion, when investors experience the agony of losing money more keenly than the joy of making the same amount of money. This may result in prudent investing choices and premature sale of profitable investments.

The tendency for investors to dismiss information that contradicts their opinions in favour of information that confirms those beliefs is known as confirmation bias. This can make people reluctant to alter their direction even when new knowledge indicates that they should.

In general, knowing how psychological biases and emotions can affect financial behaviour in the stock market can help investors make better investment decisions and enhance their long-term financial outcomes.

Why we make bad financial choices– even when we know better | Your Money and Your Mind

What Can We Learn From Behavioral Finance?

From behavioral finance, we can learn that financial decision-making is not always rational and can be impacted by psychological biases and emotions, as behavioral finance teaches us. Understanding these biases can help us make better investment choices and stay clear of typical mistakes. It emphasizes the value of diversity, establishing specific financial goals, and staying away from snap judgements influenced by feelings or peer pressure. In order to make better financial decisions, it also emphasizes the importance of continual education and self-awareness.

What Distinctions Can Be Made Between Behavioral Finance And Traditional Financial Theory?

Traditional financial theory and behavioural finance have different approaches to modelling financial markets and underlying assumptions about human behaviour.

Standard Financial Theory / Traditional Financial Theory

In general, conventional financial theory offers a framework for comprehending how investors choose their investments and how asset prices are set. It has been criticised, though, for making irrational assumptions about market efficiency and investor behaviour. Due to this, behavioral finance has emerged, which considers the influence of psychological biases and emotions on the choice of an investing strategy.

Financial Behaviour Theory

Financial behaviour theory, in its whole, aims to comprehend how people make financial decisions by taking into consideration a variety of variables, including psychological biases, cognitive constraints, and market dynamics

| Concept | Traditional Finance Theory | Behavioral Finance Theory |

| Decision-making | When making financial and investment decisions, people are unbiased and rational thinkers who can process all available information. | People are prejudiced and irrational. When they make financial and investment decisions, their emotions are a factor. |

| Consistency | Decisions are consistent, and the person making them exhibits consistent behaviour. | Inconsistent decisions are made. Different elements influence decisions. |

| Processing of Information | People have access to an infinite supply of accurate facts, knowledge, and information. They carefully consider the material before making conclusions. | According to Herbert Simon’s “Bounded Rationality,” people have a finite amount of rationality. They are unable to process all of the information. Therefore, even if the information is accurate, they will undoubtedly err in judgement. |

| Market Outlook | The market is thought to be effective. It stands for the financial market’s actual value. | The market is thought to be unstable. Market abnormalities exist as a result. |

| Risk | Risk is measurable and objective. It is calculable. | Risk is arbitrary. Each person’s capacity for risk-taking is unique and cannot be quantified with objectivity. |

How Is It Helpful to Understand Behavioral Finance?

- It can assist investors in identifying and avoiding common psychological biases and emotions, like as herding behaviour, overconfidence, loss aversion, and confirmation bias, that can result in less-than-ideal investing decisions.

- By taking into account aspects other than traditional financial measures, such as market mood and social dynamics, it can assist investors in making better educated investment decisions.

- Using tactics like diversification, goal-setting, and disciplined decision-making, it can assist investors in improving their financial decision-making.

- By identifying and addressing the psychological biases and emotions of their clients, it can help financial professionals better understand and serve them.

Overall, having a better understanding of behavioral finance can result in better investment results, better financial decision-making, and stronger client relationships for financial professionals.

What’s an illustration of a behavioral finance finding?

The disposition effect, which refers to the propensity for investors to sell winning investments too soon and hang on to lost investments for an excessive amount of time, is one example of a behavioral finance discovery. The emotional agony of realizing a loss and the urge to secure profits and avert more losses are what motivate this behaviour.

According to the disposition effect, investors should hang onto their investments until they reach their goal price, which is a divergence from the usual financial assumption of rational decision-making and efficient markets. Even after taking transaction costs into account, empirical data reveals that investors typically sell winning investments at a significantly higher pace than losing investments.

Understanding the disposition effect can aid investors in recognizing the influence of emotions on their financial decisions and in creating countermeasures, such as establishing clear investment goals and avoiding impulsive judgements based on feelings or peer pressure.

Decision-Making Errors and Biases

Decision-making biases and errors refer to the ways in which people may choose poorly based on faulty reasoning or emotional responses.

The tendency for people to seek out information that supports their preexisting views or biases while ignoring information that contradicts them is known as confirmation bias, and it is a prevalent bias. Overconfidence and an inability to examine different perspectives may result from this.

Loss aversion is another prevalent bias, which is the propensity for people to experience greater suffering from losses than pleasure from gains. This could cause people to make less-than-ideal choices, such holding onto lost investments for too long or selling profitable stocks too soon.

The availability heuristic, anchoring bias, and the sunk cost fallacy are only a few examples of various biases and errors in decision-making.

Being aware of these biases and errors might help you avoid them and make better decisions. By searching out different viewpoints and ideas, establishing clear decision-making standards, and taking the time to carefully analyse all the facts at hand, these biases can be overcome.

Understanding Investor Behavior

Investor behavior refers to the actions and decisions made by individuals when investing their money in financial assets such as stocks, bonds, and mutual funds.

Financial professionals must comprehend investor behaviour in order to create investment plans that are specific to the needs and objectives of their clients. This may entail constructing a portfolio that is ideally suited to the investor’s needs by taking into consideration personal risk preferences, financial objectives, and behavioural biases.

Overall, investor behaviour is a complicated and comprehensive field of study that necessitates knowledge of both behavioral psychology and financial theory. Investors and financial professionals can take action to combat psychological biases and make more informed investment decisions by becoming aware of how they may affect decision-making when it comes to investments.

Trading Psychology

Trading psychology describes the thoughts, feelings, and actions that affect a person’s decision-making when they trade financial instruments like stocks, bonds, and commodities.

Psychological influences like greed, overconfidence, and fear can have a big impact on traders’ decisions, which can have a bad impact on their financial situation. For instance, overconfidence may encourage traders to take on excessive risk, while fear of missing out may cause traders to make impulsive bets based on short-term market movements.

Overall, trading psychology is a key element of successful trading and investing because it has a variety of effects on decision-making and financial outcomes. Traders and investors can increase their prospects of long-term financial success by comprehending the psychological aspects that affect trading behaviour and creating practical tactics for regulating these elements.

Market Psychology

Market psychology describes the aggregate thoughts, feelings, and actions of traders and investors that affect how the financial markets function as a whole.

Market behaviour can be significantly influenced by psychological elements like fear, greed, and optimism, which can cause price changes and volatility. For instance, a wave of optimism can cause a spike in stock demand, while concern over a market slump might cause asset sales.

Investors and traders who want to recognise market trends and make educated judgements about when to buy or sell financial assets must have a solid understanding of market psychology. Indicators of market sentiment like the CBOE Volatility Index (VIX) may be examined in this regard, as well as news and social media for any indications of shifting market attitude.

The Field of Behavioral Finance is Expanding

The study of the intricate interactions between psychology and finance by researchers and practitioners is leading to an expansion of the area of behavioural finance. Researchers may now collect and examine enormous datasets to better understand investor decision-making and to spot trends and anomalies in the financial markets thanks to technological and data analytics advancements.

New studies are being conducted on subjects like the effect of social media on investor sentiment, the role of cognitive biases in financial bubbles, and the efficacy of different behavioural interventions in promoting better financial decision-making as the field continues to develop.

In general, the development of new insights and tools to assist investors in making better decisions and achieving their financial objectives is reflected in the growth of the field of behavioural finance, which is a reflection of the increasing relevance of comprehending the human side of finance.

Behavioral interview questions with answers

Here are some Behavioral interview questions and their answers.

Q. Can you tell me about a time when you had to overcome a significant challenge?

Answer: “When I was working on a project at my previous job, we encountered a problem that threatened to derail the entire project. I took the lead in identifying the root cause of the problem and worked with my team to come up with a solution. It required a lot of extra work and late nights, but we were ultimately able to overcome the challenge and deliver the project on time.”

Q. Describe a situation where you had to work with someone difficult. How did you handle it?

Answer: “At a previous job, I had a coworker who was very confrontational and difficult to work with. I made a conscious effort to remain calm and professional, and I tried to find common ground with the coworker to help us work together more effectively. I also made sure to communicate clearly and document our interactions to avoid any misunderstandings.”

Q. Tell me about a time when you had to make a difficult decision.

Answer: “At my previous job, I had to decide whether to pursue a new project that was outside of my comfort zone. It required learning new skills and taking on more responsibility, but I ultimately decided to go for it because I saw it as a valuable growth opportunity. It was challenging at times, but I learned a lot and was able to contribute to the success of the project.”

Q. Can you give me an example of when you demonstrated leadership skills?

Answer: “When I was working on a team project, I took the initiative to organize regular team meetings and set clear goals and deadlines. I also made an effort to listen to everyone’s ideas and perspectives and encouraged collaboration and open communication. As a result, we were able to work more efficiently and effectively, and we were able to deliver the project on time and within budget.”

Q. Tell me about a time when you had to adapt to a new situation.

Answer: “At my current job, we recently underwent a major restructuring that involved changes to our team structure and responsibilities. I had to quickly adapt to the new environment and learn new skills to be successful in my role. I made a point to communicate with my new team members and seek out training opportunities to help me adjust to the changes.”

FAQs :

Here are some frequently asked questions about Behavioral Finance:

What are some common behavioral biases that can impact financial decision-making?

There are many behavioral biases, but some common ones include overconfidence, loss aversion, herd behavior, and confirmation bias.

How can understanding behavioral finance help investors?

By understanding behavioral finance, investors can be more aware of their own biases and emotions and make more rational decisions. They can also better understand the behavior of other investors and how it may impact the markets.

Can behavioral finance be used to predict stock market movements?

Behavioral finance is not a crystal ball for predicting stock market movements. While it can provide insights into the behavior of investors, the stock market is complex and can be influenced by many factors beyond investor behavior.

How can financial advisors use behavioral finance to better serve their clients?

Financial advisors can use the principles of behavioral finance to help their clients identify and overcome their biases and make more rational investment decisions. They can also use these principles to better understand their clients' goals and risk tolerance.

2 Comments

Pingback: Stream India APK : Free Live Cricket, Movies

Sorry for the issue you have facing, please check it again once