- Introduction

- What is Cost Accounting ?

- Types of Cost Accounting

- Cost Accounting Techniques

- Benefits of Cost Accounting

- Challenges in Cost Accounting

- Cost Accounting in Practice

- Future Trends in Cost Accounting

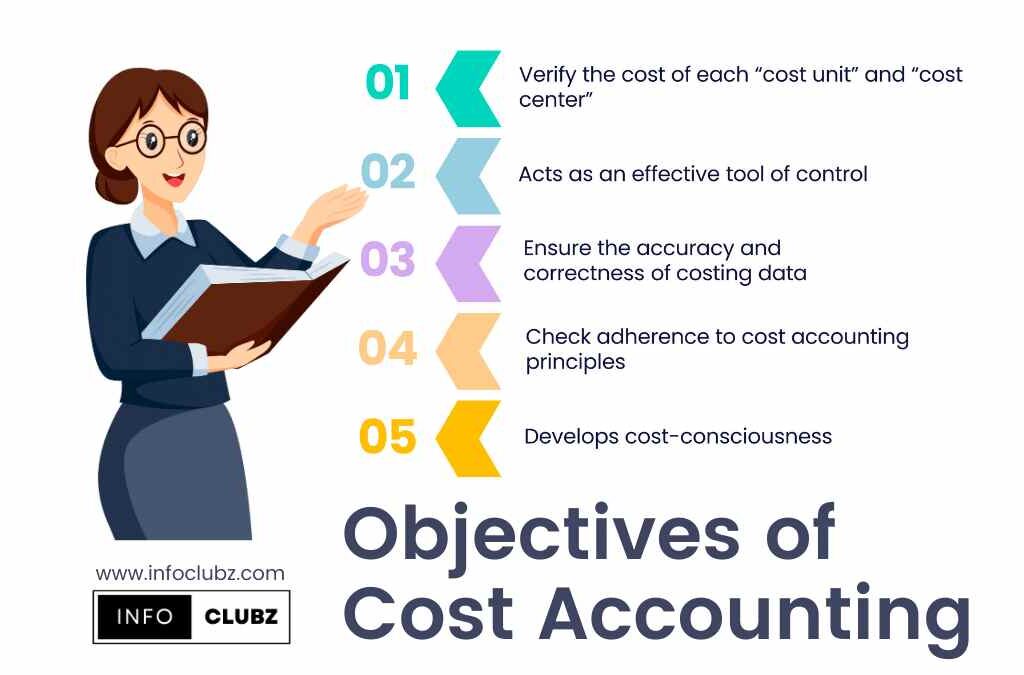

- Main Objectives of Cost Accounting

- Conclusion

- FAQs

- Importance of Cost Accounting

- Types of Costs

- Cost Accounting Methods

- Cost Accounting vs. Financial Accounting

- Cost Allocation and Cost Drivers

- Cost-Volume-Profit Analysis

- Break-Even Analysis

- Variance Analysis

- Activity-Based Costing

- Cost Accounting for Decision Making

- Cost Reduction and Cost Control

- Ethical Considerations in Cost Accounting

- Future Trends in Cost Accounting

- Conclusion

- FAQs

Introduction

Cost accounting is essential for understanding, analyzing, and optimizing’s expenses within an organization in the area of finance and business management. Cost accounting enables firms to take well-informed decisions, increase profitability, and promote sustainable growth by giving useful insights into financial activities. The depths of cost accounting will be examined in this article, along with its definition, aim, numerous methodologies, advantages, difficulties, real-world applications, and emerging trends.

What is Cost Accounting ?

Definition of Cost Accounting.

The goal of cost accounting, a specialized field of accounting, is to record, analyze, and report expenses related to a company’s operations, production, goods, or services. It involves the gathering and analysis of financial data to estimate the cost of goods or services and aids organizations in resource allocation, budgeting, and pricing decisions.

Purpose of Cost Accounting.

The main goal of cost accounting is to give management accurate and pertinent cost information so they may better manage costs, increase efficiency, and increase profitability. Businesses can use it to examine the financial performance of various departments or activities within the organization as well as to understand the cost drivers and pinpoint areas for cost reduction.

Importance of Cost Accounting.

For organizations of all sizes and in all industries, cost accounting is extremely important. It enables businesses to set reasonable pricing plans, evaluate the profitability of goods or services, decide on investments wisely, and get a competitive edge in the marketplace. Additionally, it makes it easier to comply with legal obligations and to plan and manage finances effectively.

Types of Cost Accounting

Various strategies are included in cost accounting, each of which can be applied in a distinct situation. The following are a few frequently used cost accounting models:

1. Job Order Costing

When firms produce specialized goods or services that are catered to particular client needs, job order costing is used. It entails allocating expenditures to specific activities or projects and keeping track of costs for things such raw supplies, labour, and overhead on a job-by-job basis.

2. Process Costing

When companies use continuous manufacturing or mass production methods to create identical or very similar products, process costing is used. Costs from several stages or processes are added together, giving information on the average cost per unit.

3. Activity-Based Costing

The goal of the activity-based costing (ABC) method is to identify and allocate costs according to the activities that generate them. Because it provides a more exact assessment of the resources used by each activity, firms may more precisely allocate expenses and pinpoint areas for process improvement.

4. Standard Costing

Setting predefined cost norms for various production or operational components is known as standard costing. It allows firms to pinpoint cost discrepancies, implement remedial actions, and improve cost control by comparing actual costs to predetermined benchmarks.

5. lean accounting

An technique known as “lean accounting” adheres to the same concepts as lean manufacturing or “lean management.” It seeks to reduce waste, streamline procedures, and boost overall operational effectiveness. Lean practices, such as value stream mapping and continuous improvement, are supported by lean accounting, which focuses on recording and analyzing expenses in this way.

Cost Accounting Techniques

Businesses use a range of Price tracking approaches to manage costs effectively. Several well-known methods include:

1. Cost Allocation

Distributing indirect costs among various cost objects, such as products, services, or divisions, is known as cost allocation. It assists decision-making processes and aids in determining each item’s actual cost.

2. Cost Estimation

Forecasting future expenses for a certain project, good, or service is known as cost estimate. Businesses can use it to prepare budgets, assess profitability, and take educated decisions.

3. Cost Control

The practice of monitoring and managing expenditures to make sure they complement the established objectives or budgets is known as cost control. It entails putting policies into place to cut back on wasteful spending, boost productivity, and preserve financial stability.

4. Cost Analysis

In order to understand cost behavior, cost drivers, and cost patterns, cost analysis entails evaluating and interpreting cost data. It aids in locating inefficient regions, highlighting opportunities for cost savings, and maximizing resource allocation.

Benefits of Cost Accounting

Implementing Price tracking practices can yield numerous benefits for businesses. Some notable advantages include:

1. Improved Decision-Making

By providing accurate and detailed cost information, Price tracking facilitates better decision-making at various levels within an organization. Managers can evaluate the profitability of different products or services, assess the financial viability of projects, and identify areas for cost reduction.

2. Cost Reduction

Price tracking helps identify cost-saving opportunities by analyzing various cost components. It enables businesses to streamline operations, eliminate unnecessary expenses, negotiate better pricing with suppliers, and enhance overall cost efficiency.

3. Performance Evaluation

Price tracking provides a means to evaluate the performance of different departments, products, or services. By comparing actual costs with predetermined standards, businesses can identify areas of improvement, reward top performers, and align resources to achieve strategic objectives.

Challenges in Cost Accounting

Despite its numerous benefits, Price tracking poses certain challenges that businesses must address. Some common challenges include:

1. Data Accuracy

Obtaining accurate and reliable cost data can be a complex task, especially in large organizations with diverse operations. Inaccurate data can lead to flawed cost calculations and incorrect decision-making, emphasizing the importance of robust data collection and management systems.

2. Cost Allocation Complexity

Allocating indirect costs accurately can be challenging, particularly when multiple products or services share common resources. Determining the appropriate allocation bases and developing fair allocation methods is crucial to ensure cost accuracy and fairness.

3. Technological Advancements

Technological advancements bring both opportunities and challenges for Price tracking. While automation and sophisticated software can streamline processes and enhance accuracy, their implementation requires careful planning, employee training, and data security measures.

Cost Accounting in Practice

Cost accounting finds practical application in various industries. Let’s explore two prominent sectors:

1. Manufacturing Industry

In the manufacturing industry, Price tracking helps monitor production costs, assess product profitability, and make informed decisions regarding pricing, inventory management, and process optimization. It enables manufacturers to identify cost-saving opportunities, control overhead expenses, and maintain competitive pricing strategies.

2. Service Industry

The service industry also benefits from Price tracking techniques. Service-based businesses, such as consulting firms, healthcare providers, or IT companies, can utilize cost accounting to evaluate the profitability of different service offerings, track resource utilization, and optimize pricing models.

Future Trends in Cost Accounting

As businesses continue to evolve, cost accounting is also subject to ongoing advancements. Some emerging trends include:

1. Automation and AI

Processes in cost accounting are being revolutionised by automation and artificial intelligence (AI). Automating data collection, processing, and reporting with AI-powered software can save time and increase accuracy while eliminating manual labour. Accounting professionals can devote more time to strategic efforts by using robotic process automation (RPA), which can perform monotonous duties.

2. Cloud-Based Solutions

Numerous benefits, including improved data accessibility, real-time collaboration, scalability, and data security, are provided by cloud-based cost accounting solutions. They give firms the ability to centralize data storage, streamline cost management procedures, and gain access to cost data at any time, from any location.

Main Objectives of Cost Accounting

Following is a summary of cost accounting’s primary goals:

- Cost Determination: Cost accounting aims to determine the cost of producing goods or providing services accurately. It involves collecting and analyzing costs related to various elements such as materials, labor, overheads, and other expenses. This information helps management in making informed decisions regarding pricing, profitability, and cost control.

- Cost Control: Cost accounting plays a vital role in controlling costs within an organization. By identifying cost variances, analyzing cost drivers, and comparing actual costs against budgeted costs, managers can take corrective actions to control expenses. This objective helps in improving operational efficiency and reducing wastage.

- Profitability Analysis: Cost accounting helps in analyzing the profitability of products, services, departments, or projects. It provides insights into the contribution margin, break-even point, and profitability ratios, which aid in identifying the most profitable areas of the business. This information enables management to allocate resources effectively and make strategic decisions to maximize profitability.

- Decision Making: Cost accounting provides crucial information for decision making. It helps in evaluating the financial viability of various alternatives by considering their costs, benefits, and potential risks. Cost data assists in decisions related to product pricing, make-or-buy analysis, investment appraisal, and resource allocation.

- Performance Evaluation: Cost accounting facilitates the evaluation of the performance of different departments, products, or individuals within an organization. By comparing actual costs against predetermined standards, variances can be identified and analyzed. This information helps in assessing efficiency, identifying areas of improvement, and rewarding or incentivizing employees based on their performance.

- Budgeting and Forecasting: Cost accounting provides essential data for the preparation of budgets and forecasts. By analyzing historical cost patterns and future expectations, managers can estimate costs and revenues, set realistic targets, and monitor performance against these targets. Budgeting and forecasting help in financial planning, resource allocation, and ensuring the financial stability of the organization.

- Inventory Valuation: Cost accounting plays a crucial role in valuing inventory. It helps in determining the cost of goods sold (COGS) and the value of ending inventory. Accurate inventory valuation is essential for preparing financial statements, calculating taxable income, and assessing the financial position of the organization.

Overall, the primary objectives of Price tracking revolve around cost determination, cost control, profitability analysis, decision making, performance evaluation, budgeting and forecasting, and inventory valuation. These objectives enable organizations to make informed financial decisions, improve efficiency, and achieve their financial goals.

Conclusion

Price tracking is an essential tool for businesses to understand, control, and optimize their costs effectively. By utilizing various cost accounting techniques, organizations can make informed decisions, reduce expenses, enhance performance, and gain a competitive edge in the market. While challenges exist, advancements in technology and evolving practices promise a future where cost accounting becomes more efficient, accurate, and valuable than ever before.

FAQs

What are the main types of cost accounting?

The main types of cost accounting include job order costing, process costing, activity-based costing, standard costing, and lean accounting. Each type is suitable for different scenarios and provides insights into specific aspects of costs and resource allocation.

How does cost accounting contribute to cost reduction?

Cost accounting contributes to cost reduction by analyzing cost components, identifying inefficiencies, streamlining operations, negotiating better pricing with suppliers, and optimizing resource allocation. It helps businesses eliminate unnecessary expenses and enhance overall cost efficiency.

How does cost accounting benefit the manufacturing industry?

In the manufacturing industry, cost accounting helps monitor production costs, assess product profitability, optimize pricing and inventory management, and identify cost-saving opportunities. It enables manufacturers to control overhead expenses and maintain competitive pricing strategies.

What are the future trends in cost accounting?

The future trends in cost accounting include automation and AI, where artificial intelligence-powered software automates data collection, analysis, and reporting. Cloud-based solutions are also emerging, offering enhanced data accessibility, real-time collaboration, scalability, and data security. These trends promise more efficient and accurate cost accounting processes.

Importance of Cost Accounting

Cost accounting plays a critical role in business decision-making processes. It provides valuable insights into the cost structure of a company, allowing managers to identify areas of inefficiency and take appropriate actions to reduce costs. By implementing cost accounting techniques, businesses can streamline their operations, enhance productivity, and gain a competitive advantage in the market. Moreover, cost accounting helps in setting realistic pricing strategies, evaluating product profitability, and assessing the financial viability of projects.

Types of Costs

In cost accounting, costs are classified into various categories based on their behavior and relationship to production or service delivery. These categories include:

- Direct Costs

Direct costs are expenses directly attributable to a specific product or service. They include materials, labor, and other direct expenses that can be easily traced to a particular cost object. - Indirect Costs

Indirect costs, also known as overhead costs, are expenses that cannot be directly linked to a specific product or service. Examples include rent, utilities, administrative salaries, and maintenance costs. - Fixed Costs

Fixed costs remain constant within a certain production or activity level. They do not change with variations in output. Examples include rent, insurance premiums, and annual salaries. - Variable Costs

Variable costs fluctuate in direct proportion to the level of production or activity. Examples include raw materials, direct labor, and sales commissions. - Semi-Variable Costs

Semi-variable costs have both fixed and variable components. They consist of a fixed portion that remains constant and a variable portion that changes with production levels. Telephone bills and utility costs are examples of semi-variable costs.

Cost Accounting Methods

There are various methods used in cost accounting to track, allocate, and analyze costs. Some commonly used methods include:

- Job Order Costing

Job order costing is used when products or services are produced based on customer orders or specific projects. It involves tracking the costs associated with each job or project separately, allowing for accurate cost determination and pricing. - Process Costing

Process costing is employed in industries where large quantities of identical or similar products are produced in a continuous production process. Costs are accumulated and averaged over the entire production process to determine the cost per unit. - Standard Costing

Standard costing involves setting predetermined standards for costs and comparing them with actual costs incurred. Variances are analyzed to identify areas of improvement and cost control. - Activity-Based Costing (ABC)

Activity-Based Costing is a method that assigns costs based on the activities involved in producing a product or service. It provides a more accurate allocation of costs by considering various cost drivers and activities that consume resources.

Cost Accounting vs. Financial Accounting

While cost accounting and financial accounting are related, they serve different purposes within an organization. Financial accounting focuses on providing financial information to external stakeholders, such as investors, creditors, and regulatory authorities. In contrast, cost accounting is primarily used for internal decision-making purposes, enabling managers to control costs, evaluate performance, and improve operational efficiency.

Cost Allocation and Cost Drivers

Cost allocation is the process of assigning costs to various cost objects, such as products, services, or departments. It helps in understanding the true cost of producing goods or delivering services. Cost drivers, on the other hand, are the factors that cause costs to change. Identifying and analyzing cost drivers is essential for effective cost management and decision-making.

Cost-Volume-Profit Analysis

Cost-Volume-Profit (CVP) analysis is a powerful tool used in cost accounting to understand the relationship between costs, volume, and profit. By analyzing the effects of changes in sales volume, selling prices, variable costs, and fixed costs, managers can make informed decisions regarding pricing strategies, breakeven points, and profitability.

Break-Even Analysis

Break-even analysis is a technique used to determine the level of sales or production at which a company neither makes a profit nor incurs a loss. It helps in understanding the minimum sales required to cover all costs and provides insights into the financial feasibility of new products or services.

Variance Analysis

Variance analysis involves comparing actual costs and revenues with standard or budgeted amounts to identify discrepancies. By analyzing variances, managers can pinpoint areas of inefficiency or unexpected results and take corrective actions to improve performance.

Activity-Based Costing

Activity-Based Costing (ABC) is an advanced cost accounting technique that assigns costs based on the activities that consume resources. It provides a more accurate picture of product costs by considering various cost drivers and activity levels. ABC helps organizations identify the true costs of products or services and make informed decisions regarding pricing, product mix, and process improvement.

Cost Accounting for Decision Making

Cost accounting provides essential information for decision-making processes within an organization. By analyzing costs and profitability, managers can evaluate the financial viability of various projects, assess the impact of pricing decisions, and make informed choices regarding resource allocation.

Cost Reduction and Cost Control

Cost reduction and cost control are integral aspects of cost accounting. Organizations strive to minimize costs while maintaining or enhancing the quality of products or services. By identifying cost-saving opportunities, eliminating waste, and optimizing processes, businesses can improve their bottom line and achieve sustainable growth.

Ethical Considerations in Cost Accounting

Ethics play a crucial role in cost accounting. Accountants and managers must adhere to ethical standards and principles when collecting and reporting cost-related information. Transparency, accuracy, and fairness are vital to ensure the integrity of cost accounting practices and build trust among stakeholders.

Future Trends in Cost Accounting

As technology advances and business landscapes evolve, cost accounting is also undergoing significant transformations. Automation, data analytics, and artificial intelligence are revolutionizing the way costs are tracked, analyzed, and managed. The integration of cost accounting systems with enterprise resource planning (ERP) software allows for real-time monitoring and decision-making. These advancements enable organizations to gain deeper insights, optimize processes, and adapt to changing market dynamics.

Conclusion

In conclusion, cost accounting is an essential discipline for managing costs and making informed business decisions. By accurately tracking costs, analyzing variances, and implementing cost reduction strategies, organizations can improve profitability, enhance operational efficiency, and gain a competitive edge. Ethical considerations, future trends, and advancements in technology further contribute to the evolution of cost accounting practices.

FAQs

- What is the role of cost accounting in business?

Cost accounting helps businesses manage costs effectively, make informed decisions, set realistic pricing strategies, and evaluate profitability. - How does cost accounting differ from financial accounting?

Cost accounting focuses on internal decision-making, while financial accounting provides financial information to external stakeholders. - What are the types of costs in cost accounting?

Types of costs include direct costs, indirect costs, fixed costs, variable costs, and semi-variable costs. - How does cost accounting contribute to decision-making?

Cost accounting provides valuable information for evaluating project viability, assessing pricing decisions, and resource allocation. - What are the future trends in cost accounting?

Future trends in cost accounting include automation, data analytics, artificial intelligence, and integration with ERP systems.